Let’s talk about one of the most important numbers in your business: Cost Per Acquisition, or CPA.

In simple terms, CPA is the total price you pay to get one new paying customer from a specific marketing campaign. Think of it as the final receipt for each new customer you bring through the door using your advertising dollars.

Understanding Cost Per Acquisition in Simple Terms

Let's cut through the jargon with a quick analogy. Imagine your online store is a real brick-and-mortar shop on a busy street. To get people to come in, you decide to print some flyers, run a local radio ad, and put up a brand-new sign out front.

At the end of the month, you add up what you spent on the flyers, the ad spot, and that new sign. That’s your total marketing spend.

Next, you count how many new people came in and actually bought something because they saw one of your promotions. When you divide your total marketing cost by that number of new customers, you get your Cost Per Acquisition. It’s the average price tag for each successful sale you generated.

The Core CPA Formula

The formula for calculating CPA is refreshingly straightforward, yet incredibly powerful:

CPA = Total Marketing Spend ÷ New Customers Acquired

This single number is one of the most critical health metrics for any online business. It tells you exactly how efficient your advertising is at turning dollars into actual, paying customers—not just clicks, impressions, or 'likes'.

By mastering your CPA, you shift from just guessing about your ad performance to making precise, data-driven decisions that fuel profitable growth. It's the difference between just spending money and investing it wisely.

CPA at a Glance Why It Matters

To put it all together, here’s a quick breakdown of what CPA is and why it's so vital for any online seller.

| Concept | What It Measures | Why It's Critical |

|---|---|---|

| Cost Per Acquisition | The average cost to acquire one new customer through a specific marketing or ad campaign. | It directly links marketing spend to revenue, revealing the true profitability of your efforts. |

Knowing this number inside and out is the key to scaling your business without burning through cash.

Why This Metric Is Crucial

Understanding what is cost per acquisition allows you to measure the direct financial return on your marketing campaigns. Without it, you're essentially flying blind, unable to tell if your advertising is a profitable engine or just a costly expense.

A clear handle on your CPA helps you:

- Allocate your budget effectively: You can confidently move money toward the campaigns and channels that deliver customers at the lowest cost.

- Assess campaign profitability: By comparing CPA to your average order value (AOV), you can see instantly if you're making money on that first purchase.

- Optimize for better results: Knowing your baseline CPA is the first step toward improving it and making every single marketing dollar work harder for you.

How to Nail Down Your Real CPA

The basic formula for CPA looks simple on paper: Total Marketing Cost ÷ New Customers Acquired. But getting this right is the difference between a fuzzy guess and a number you can actually build a business on. The real magic—and accuracy—comes from how you define those two parts of the equation.

Let's break it down so your calculation is rock-solid.

First, you have to be honest about your marketing costs. It’s easy to just look at your monthly Facebook or Google ad spend and call it a day. But a true calculation goes much deeper, including every single expense that went into getting that customer through the door.

Your Total Marketing Cost isn’t just your ad spend. It’s the full picture of every direct expense that helped you win new customers, from the tools you use to the people you pay. If you ignore these costs, you’ll end up with a dangerously low CPA that gives you a false sense of security.

What to Actually Include in Your Total Marketing Cost

To get a number you can trust, your cost breakdown needs to include:

- Direct Ad Spend: This is the obvious one—the money you pay directly to platforms like Google Ads, Instagram, TikTok, or Amazon to run your ads.

- Software and Tool Subscriptions: Think about the monthly fees for your email platform, any analytics tools, or other software you used to run the campaign. They all count.

- Creative and Content Production: Did you hire a graphic designer? A copywriter? These costs for creating the ads themselves need to be factored in. This also includes tools like ProdShot, which can be a super cost-effective way to generate high-quality product images without a big photoshoot budget. You can check out the pricing options here.

- Influencer or Affiliate Fees: Any cash you paid to partners who promoted your product and drove sales for this specific campaign absolutely has to be in the mix.

What Exactly Counts as a "True Acquisition"?

The other side of the formula is just as important. What are you counting as an “acquisition”? For most online sellers, this should mean one thing and one thing only: a new paying customer.

Why? Because lumping in repeat buyers will seriously skew your numbers. The cost to get an existing customer to buy again is almost always way lower than finding and converting a brand new one.

Let's walk through a real-world example. Imagine you're a Shopify store owner and you just finished a month-long Facebook ad campaign.

- Facebook Ad Spend: $1,500

- Email Marketing Software (Klaviyo): $50

- Influencer Collaboration Fee: $250

- Total Marketing Cost: $1,800

Over that month, the campaign brought in 75 brand new customers.

Now, let's plug it into the formula: $1,800 / 75 = $24 CPA

Boom. You now know it cost you exactly $24 to acquire each new customer from that campaign. With a real number like this, you can confidently stack it up against your product's profit margin and see if your marketing is actually making you money. If you want to dig even deeper, a detailed customer acquisition cost calculator guide can be a huge help.

Benchmarking Your CPA Across Marketing Channels

So, you’ve calculated your cost per acquisition. Now for the million-dollar question: is that number any good? The honest answer is, it completely depends on where you’re spending your money. A CPA that’s a home run on one channel might be a total bust on another.

Expecting the same CPA across all your marketing channels is like expecting a speedboat and a cargo ship to have the same fuel costs—they’re built for entirely different journeys. A customer actively searching on Google for a product you sell has a much higher intent to buy than someone idly scrolling through TikTok. This fundamental difference in a person's mindset is what drives the huge variance in acquisition costs.

To really get a grip on what your CPA means for your business, you have to look at it channel by channel. This is how you spot the real winners and pull the plug on the budget-drainers.

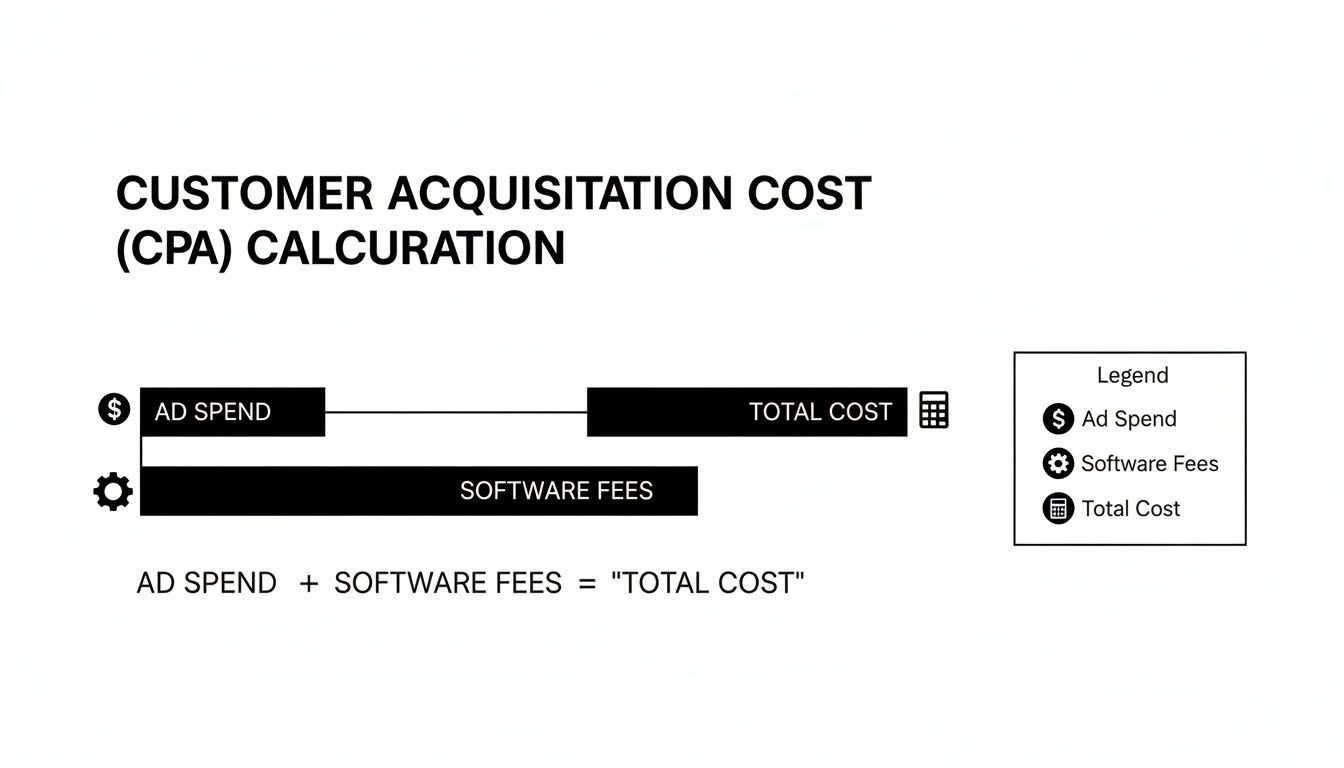

This visual breaks down all the little things that add up to your total cost, which is the "cost" part of the CPA formula.

As you can see, your true cost is more than just what you pay for the ad itself. It’s the sum of all the direct expenses you shelled out to get that one customer across the finish line.

Why User Intent Shapes Your Costs

The single biggest factor messing with your CPA is user intent. Someone typing "buy black leather tote bag" into Google is basically holding their wallet out. They're a high-value target, which means they're also more expensive to reach. On the flip side, a user on Instagram is there to see what their friends are up to, so your ad has to work much harder to interrupt their scroll and spark a desire to buy.

Let's break down a couple of common scenarios:

- High-Intent Channels (e.g., Google Search, Amazon Ads): On these platforms, you're meeting existing demand. People are already looking. Competition for keywords can get intense and drive up costs, but your conversion rates are usually much higher. A bigger CPA here can be perfectly fine if it's bringing in profitable sales right away.

- Discovery Channels (e.g., Instagram, TikTok, Pinterest): Here, you’re creating demand from scratch. Users aren't in shopping mode, so your creative—the ad image or video—has to do all the heavy lifting. CPAs can be lower, but you often have to kiss a lot of frogs (show your ad to a lot of people) to find your prince (the interested buyer).

Typical CPA Benchmarks for Online Sellers

While the numbers are always shifting, it helps to know the general lay of the land. For e-commerce businesses, the average CPA for search ads is around $45.27, while display ads are closer to $65.80. This is why the quality of your ad creative is so critical, especially for sellers on Shopify, Amazon, and Etsy who are using AI to generate conversion-ready images from simple smartphone photos.

Key Takeaway: Stop chasing one "magic" CPA number for your entire marketing plan. Instead, set a unique target for each channel based on its role and the audience's mindset. It's a much smarter way to allocate your budget.

Ultimately, the goal is to find a mix of channels that gives you a profitable blended CPA. For agencies juggling multiple client accounts, understanding these differences is what separates the pros from the amateurs. Knowing which platforms drive instant sales versus which ones build your brand over time lets you build a more resilient and effective marketing machine for your clients. In fact, many ad agencies use specialized tools to quickly create high-performing visuals tailored to each specific channel. This segmented approach ensures you're not just spending money, but investing it where it will bring back the best return.

Avoiding Common Metric Confusion

In the world of marketing metrics, clarity is profit. Seriously. Getting your terms mixed up can lead to some seriously expensive mistakes, which is why it's so important to know exactly what you’re measuring. Even pros sometimes use related metrics interchangeably, and that's when the waters get muddy.

The most common mix-up? Cost Per Acquisition (CPA) and Customer Acquisition Cost (CAC). They sound alike, and they're definitely related, but they tell you two very different stories about your business's health. Think of them as relatives, not twins.

Clarity is crucial: While CPA focuses on the cost of a specific marketing action leading to a sale, CAC takes a panoramic view of all costs required to gain a new customer.

CPA vs. CAC: The Critical Difference

So, what really sets them apart? It all comes down to scope.

Cost Per Acquisition (CPA) is your tactical, in-the-trenches metric. It measures what it costs to get a customer from one specific source, like a single Google Ads campaign. CPA helps you decide if that particular ad is actually making you money.

Customer Acquisition Cost (CAC), on the other hand, is strategic and looks at the big picture. It rolls up your total marketing and sales costs over a set period—salaries, software, ad spend, you name it—and divides it by all the new customers you brought in. This tells you the total cost to the business to land a new customer, period.

For a lot of direct-to-consumer ecommerce stores running lean without big sales teams, the lines can blur, and you'll often hear the terms used as if they're the same. But looking at broader trends shows why the distinction matters. The average CAC has shot up over 222% in recent years, a spike fueled by platform competition and privacy changes. If you're curious, you can explore detailed ecommerce CAC benchmarks to see how you stack up.

CPA vs. CPL: Acquiring Actions vs. Leads

Another frequent point of confusion is the difference between Cost Per Acquisition and Cost Per Lead (CPL). This one is simple but super important.

- CPL measures the cost to get a potential customer's contact info. Think of an email signup from a pop-up form. They haven't bought anything yet, but they've raised their hand.

- CPA measures the cost to get an actual paying customer. This is the person who went all the way and completed a purchase.

Nailing these distinctions isn't just academic—it's essential. It makes sure you're tracking the right numbers for your goals and reading your data correctly. It's the difference between celebrating high-cost "wins" that are secretly draining your bank account and making truly profitable decisions.

Actionable Strategies To Lower Your CPA

Knowing your CPA is one thing. Actively driving it down is where you really start winning. A high CPA can feel like a leak in your budget, draining your funds and stopping growth in its tracks. But the good news is, you're in the driver's seat.

This isn't about slashing your ad spend. It's about making every dollar you do spend work harder and smarter. Once you have a firm grip on your current CPA, you can start pulling the right levers and explore proven strategies to reduce customer acquisition cost that will seriously boost your ROI.

Upgrade Your Ad Creative And Product Imagery

Let's be blunt: in a sea of online ads, the visual is everything. It's the single biggest factor that determines whether someone even bothers to stop scrolling. In a crowded feed, generic, low-effort product photos are completely invisible. Your ad creative is your digital storefront, and it has about one second to make an impression.

Put yourself in your customer's shoes. A crisp, compelling, and professional image signals quality and builds instant trust. It lowers their perceived risk of buying from you and makes them much more likely to click. That click improves your click-through rate (CTR), which in turn tells platforms like Google and Meta to reward you with a lower CPA.

High-quality visuals don't have to break the bank. For example, the fashion and apparel space sees an average CPA of around $66, a number that can quickly get out of hand for small sellers paying for expensive photoshoots. This is where AI tools like ProdShot come in, letting you skip the costly studio time by turning simple smartphone pictures into professional, marketplace-ready images. It's a direct path to compressing your CPA.

Key Insight: Your product images aren't just pictures; they are your most powerful conversion tool. Investing in high-quality visuals is a direct investment in lowering your Cost Per Acquisition.

Optimize Your Landing Page And Sales Funnel

Getting the click is only half the battle. If your landing page is clunky, confusing, or slow, you’ll lose the very customer you just paid to attract. A high bounce rate is a massive red flag for ad platforms, signaling a poor user experience—and they'll often make you pay for it with higher costs.

To cut down on that friction and lower your CPA, zero in on these areas:

- Improve Page Speed: A slow-loading page is a conversion killer. Seriously, even a one-second delay can send your bounce rate through the roof.

- Strengthen Your Offer: Make sure your headline, copy, and call-to-action (CTA) are laser-focused and match the promise you made in the ad. No bait-and-switch.

- Simplify the Checkout Process: Get rid of any unnecessary fields or steps. The fewer clicks it takes to buy, the more people will actually complete the purchase.

Refine Your Audience Targeting

The final piece of the puzzle is making sure your stunning ad and slick landing page are actually seen by the right people. Showing an ad for high-end jewelry to an audience looking for budget accessories is just throwing money away and watching your CPA skyrocket.

Dive into your analytics and get to know your best customers. Who are they? What do they care about? Use that data to build lookalike audiences and get super specific with your targeting based on demographics, interests, and buying behaviors.

The more precisely you can dial in on your ideal customer, the less you'll waste on clicks from people who will never convert. If you're wondering about the investment required for professional visuals, our guide on the cost of professional product photography offers valuable insights.

To help you prioritize, here’s a quick look at where you can get the biggest bang for your buck when trying to lower your CPA.

High-Impact Levers For Reducing Your CPA

| Strategy | Potential Impact | Effort Level |

|---|---|---|

| Upgrade Ad & Product Imagery | High | Low to Medium |

| Optimize Landing Page Speed | High | Medium |

| Refine Audience Targeting | High | Medium |

| Improve Ad Copy & CTA | Medium | Low |

| Simplify Checkout Funnel | Medium | Medium to High |

| A/B Test Different Offers | Medium | Low |

Focusing on high-impact, low-effort tasks first—like upgrading your visuals—can give you quick wins that fund more intensive efforts down the road.

Your Top CPA Questions, Answered

Once you get the hang of the basics, a bunch of practical questions always pop up when you start applying CPA to your actual online store. Let's tackle the most common ones so you can track and slash your acquisition costs like a pro.

What’s a Good Cost Per Acquisition for a New Online Store?

This is the million-dollar question, but the answer is surprisingly simple: there's no magic number. A "good" CPA is completely unique to your business because it all comes down to your product prices and profit margins.

For a new store just getting its feet wet, a great rule of thumb is to aim for a CPA that’s comfortably lower than your Average Order Value (AOV). For instance, if your average customer spends $75 an order, landing a customer for $50 means you're profitable right from their very first purchase. That's a win.

Down the road, you'll get a feel for your Customer Lifetime Value (LTV)—the total amount a customer is likely to spend with you over time. Once you know that, a "good" CPA becomes any cost that's sustainably lower than your LTV, locking in your store’s long-term health.

How Often Should I Be Calculating My CPA?

The right rhythm really depends on what you're trying to figure out.

When you're running active ad campaigns on platforms like Meta or Google, you need to be in the trenches. That means checking your CPA daily, or weekly at the absolute minimum. This lets you react fast, kill the ads that are burning cash, and double down on the ones that are actually working.

For the bigger picture, calculating your overall CPA on a monthly and quarterly basis is perfect. This helps you spot broader trends, see how seasons affect your sales, and get a solid read on the overall health of your marketing engine. Consistency here is what turns data into smart decisions.

My CPA Is Through the Roof! What Do I Fix First?

If your CPA is making you sweat, don't panic. You want to focus on the two levers that give you the biggest, fastest results: your ad creative and your landing page.

First, take a hard look at your visuals. Are your product images good enough to stop someone mid-scroll? Is your ad copy speaking directly to a real customer problem or desire? More often than not, upgrading your product imagery is the single quickest win you can get.

A killer product photo can be the difference between a glance and a click. Boosting your click-through rates and conversions with better images has a direct, immediate impact on lowering your CPA. It's one of the highest-leverage changes you can possibly make.

At the same time, make sure your landing page is a dream to use. It needs to be fast, clear, and easy to navigate on a phone. The journey from your ad to the checkout button has to be absolutely seamless if you want to convert the traffic you're paying for.

Ready to slash your CPA with stunning visuals? ProdShot uses AI to transform your simple smartphone photos into professional-grade product images in seconds. Stop letting poor creative drain your ad spend and start converting more clicks into customers. Try ProdShot for free today!